Using our pre-formatted model formats, we can provide very fast turnaround

The Interim Controller provides this model as a consulting service described below.

We have been called in exclusively for budget preparation for many of our clients. We can prepare multiple department, multiple location and multiple subsidiary budgets all rolled up into a corporate financial plan.

We can assist the existing Controller or CFO, or we can conduct the entire budgeting process including department/subsidiary manager interviews for accurate collection of resource data. We provide the resources to get the job done, you provide the operating methodology.

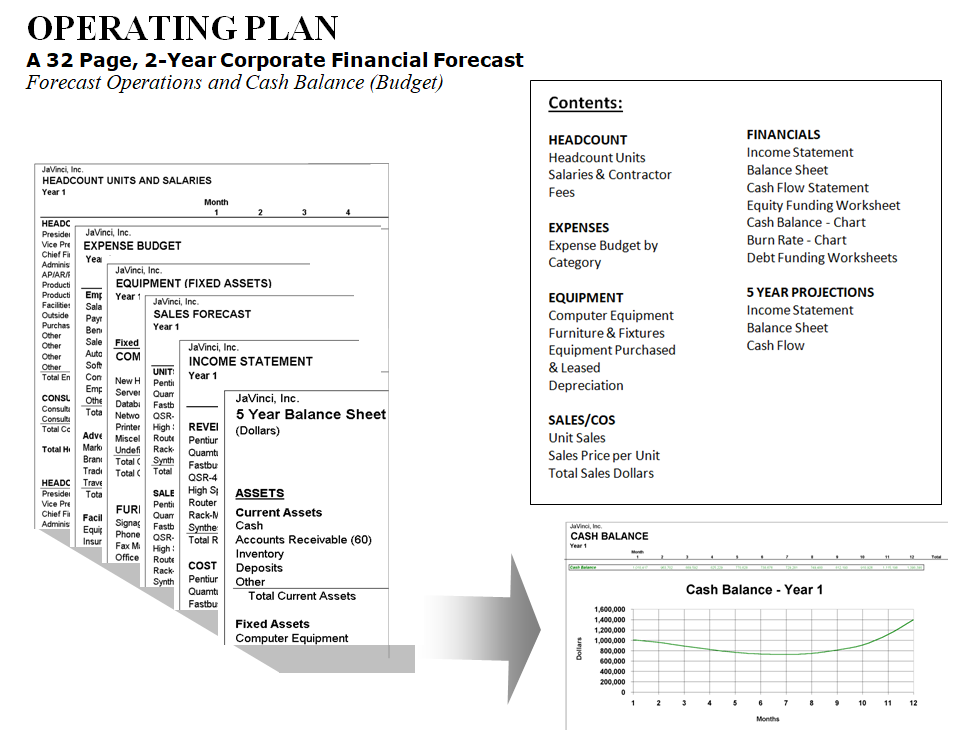

Our method is a 24 month, resource-based version of budgeting. We work with you to detail the resources needed to accomplish your goals, the model then automatically produces your financial projections. All numbers have detail support behind them so you are never at a loss as to how to explain where the numbers came from. We start with your current balance sheet and move forward by month for two years.

HEADCOUNT - We start by defining your headcount and headcount additions by month for the next 1-2 years

SALARIES - Each employee and prospective employee is then assigned an annual salary

OPERATING EXPENSES - Add in the department expenses needed to accomplish your defined goals

FIXED ASSETS - Adding in the expected equipment purchases for each department rolls these up to the balance sheet for our cash calculation

REVENUE - Sales are identified by product/product line and selling prices are determined to develop a gross sales profile

COST OF SALES - If your company produces a product or service, we apply an accurate summary cost of sales percentage to the sales made. Detailed COGS schedules can be developed.

DEBT FINANCING - If you do, or will, finance your company with debt sources, these are defined and rolled into the balance sheet. Our modeling provides for straight notes (amortized or interest only), lines of credit, capital equipment financing and operating leases.

EQUITY FINANCING - Capital raised is added to a graphic schedule that rolls into the balance sheet

BANK BALANCE CHART - We track the resulting bank balance in an easy to read chart that shows how your company will grow its cash balance or if a start-up, eventually become cash independent. Every change that you make to a particular resource in this model, is reflected in the cash balance.

EXPENSE BURN RATE CHART - A comparative bar chart illustrating how much money you are spending in any given month. An excellent tool for visually comparing your month-to-month growth in expense burn.

5-YEAR INCOME STATEMENT, BALANCE SHEET and CASH FLOW - These statements are produced for inclusion into your business plan.

We recommend indexing all of the Landscape-formated worksheets into a tabbed 3-ring binder providing a resource for instant answers during meetings or budget reviews. This is the "Rolls-Royce" of budget models that has been used in raising over 1.2 billion dollars of investment capital in Silicon Valley.

A license for use is granted to the company for their ongoing updates and future modifications and reuse in future years.